Your basket is currently empty!

Category: Uncategorized

-

After a period of strength for the Chinese Yuan (CNH), the tides may be turning in favor of the US dollar (USD). While recent appreciation in the yuan has caught the attention of the People’s Bank of China (PBoC), growing concerns over China’s fragile recovery and global macro dynamics are fueling expectations that USDCNH may…

-

The USDCAD pair appears to be entering a technically significant bearish phase. The pair has failed to hold above the 1.3860 zone, forming a triple top pattern that historically triggered medium-term declines. 🔍 Key Technical Observations: • Downward Pressure Confirmed: A series of lower highs suggests sustained selling pressure. • First Major Target: The initial…

-

For traders navigating forex, commodities, and indices, understanding what drives market movements each week is crucial. At FXEQ Trading Limited, we don’t just trade price action—we trade the drivers behind it by managing the risk, because we aren’t always on the right side of the trade. Here’s a breakdown of the key forces and sources…

-

In recent weeks, the financial world has turned its attention to the U.S. Congress as lawmakers debate the so-called “One Big Beautiful Bill.” Criticised by business leaders like Elon Musk as an “outrageous pork-filled spending spree,” this bill promises trillions in new federal spending over the next decade. But what does it mean for the…

-

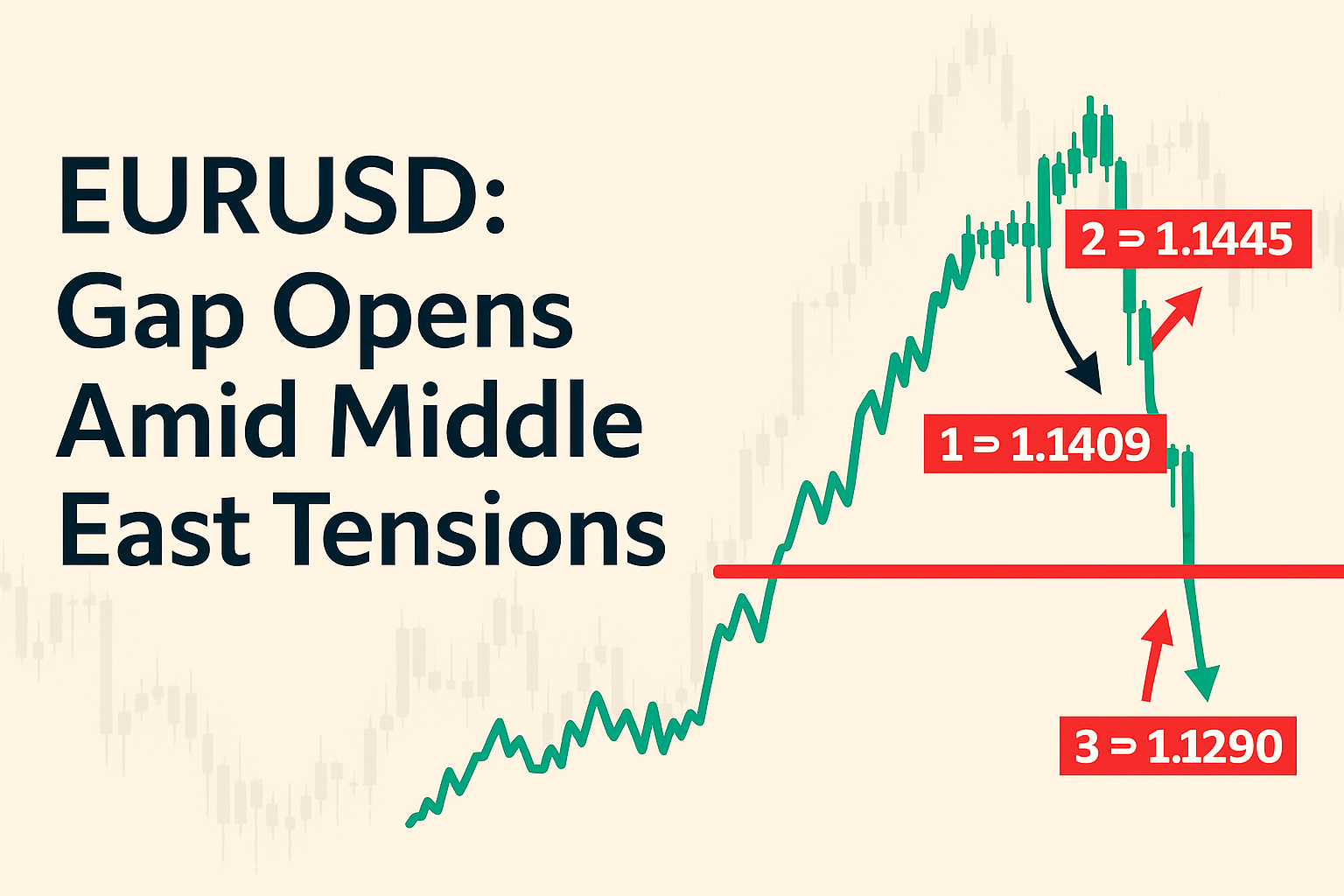

The EURUSD pair closed last Friday (20/06/2025) at 1.15214, and as markets reopens today (22/06/2025) at 10pm UK time, the pair will open with a downside gap around 1.1470. This bearish gap comes amid escalating tensions in the Middle East, raising investor caution and driving flows into the U.S. Dollar as a safe-haven currency. Why…

-

As tensions intensify in the Middle East, financial markets are entering the new week with a heavy risk-off tone. One of the assets likely to react first to these developments is gold (XAUUSD). Based on our multi-timeframe analysis and weekend indicators, we anticipate a potential bullish gap at market open today, with the price of…

-

After a relentless rally from the March lows, the NASDAQ 100 (NAS100) appears to be entering a much-needed cooldown phase. With price action showing signs of local exhaustion and overhead resistance near all-time highs, traders may be eyeing a pullback — not as a bearish reversal, but as a buy-the-dip opportunity into a strong trend.…

-

In the ever-volatile world of crude oil, moments of technical clarity combined with macro catalysts are rare — and potentially very rewarding. One such moment may be unfolding right now in WTI crude, where both chart structure and global headlines point to a potential move toward $80. 🧭 The Technical Setup: Price Vacuum at $75–$76.50…

-

The markets are once again being shaped by something more than earnings or interest rates: politics and personalities. The brewing tension between Donald Trump and Elon Musk isn’t just a headline — it could spark a ripple effect across tech, clean energy, and even geopolitical positioning. ⚡ What’s Happening? In recent months, Donald Trump has…

-

Trading, whether in forex, indices, commodities, or stocks, has never been more accessible. With mobile apps, commission-free platforms, and endless online content, the barriers to entry are lower than ever. But here’s the real question: Is trading for everyone? 🎯 The Appeal of Trading From the outside, trading looks appealing — flexibility, independence, and the…