Your basket is currently empty!

Category: Uncategorized

-

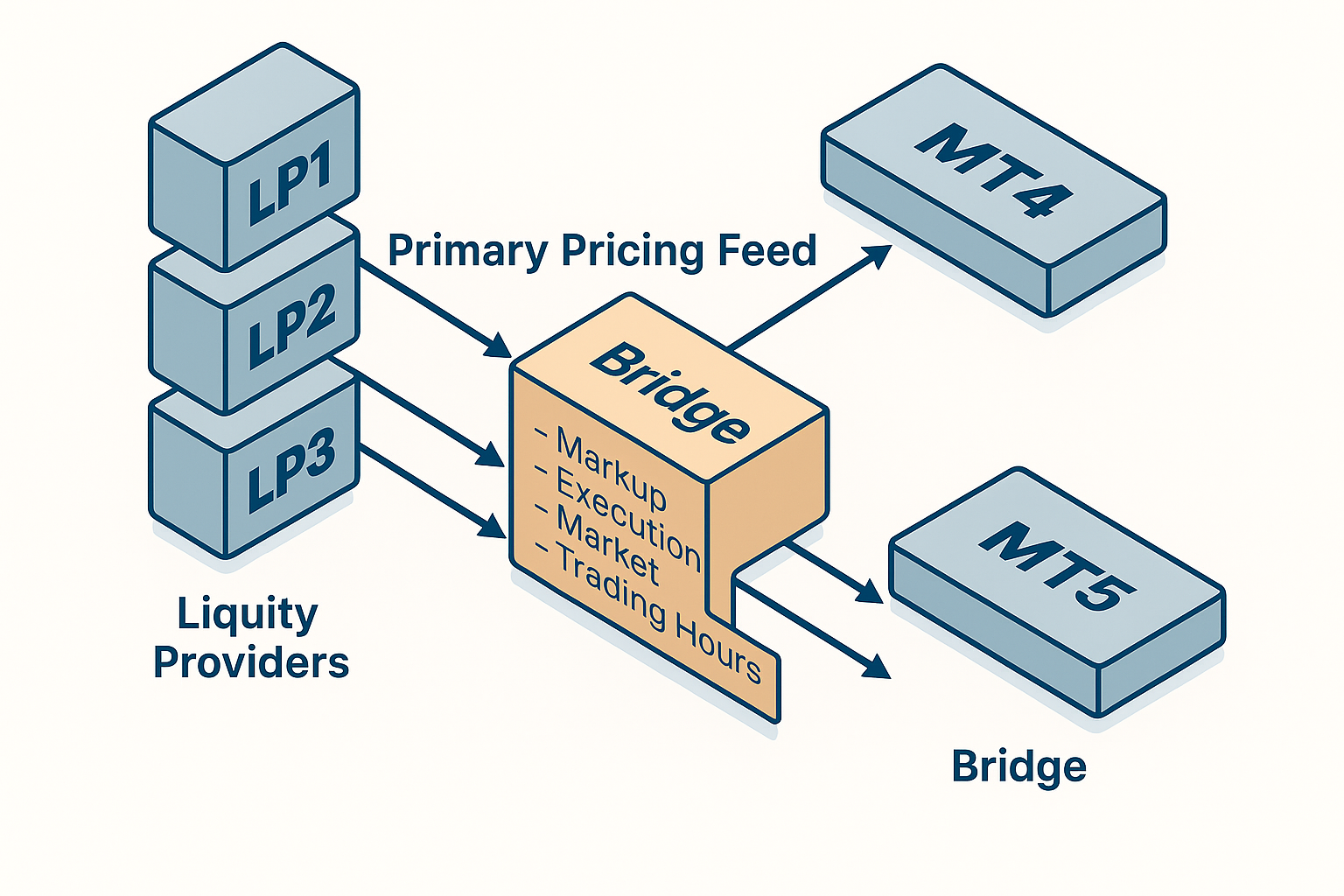

Introduction In the fast-moving world of forex trading, brokers must ensure they provide traders with the most competitive prices, fastest execution, and minimal downtime. Achieving this requires a carefully structured infrastructure — one that connects multiple Liquidity Providers (LPs) through a Bridge to popular trading platforms like MT4 and MT5. The Role of Liquidity Providers…

-

Arbitrage in financial markets is often elusive — a textbook concept that rarely survives the friction of the real world. But today (08/08/2025), we capitalised on a genuine price divergence between spot gold (XAUUSD) and December 2025 gold futures (GOLDft). And unlike typical inefficiencies, this one was not a mispricing, but rather the result of…

-

Last week delivered a double dose of macro catalysts: Wednesday’s FOMC statement and press conference, followed by Friday’s Non-Farm Payrolls (NFP). Together, these events injected volatility into major markets. Here’s our structured review — and how our predefined levels continue to hold relevance. 🏛️ Fed Recap: Hawkish Pause, Dollar Strength During Wednesday evening’s press conference,…

-

In our previous article, “EURUSD Gap Opens as Middle East Tensions Mount – Bearish Outlook Toward 1.1290,” we highlighted downside risks following a geopolitical-driven gap lower. The market initially respected that weakness, but as broader macro and technical signals evolved, so has our view. The bearish thesis is now neutralised. Instead, we’re observing a bullish…

-

In our earlier article, “XAUUSD Outlook: Geopolitical Tensions and BTCUSD Indications Point Toward 3,400 and Beyond,” we outlined a bullish setup in gold, projecting potential toward the 3,400+ region. Since then, price action has respected key levels — and we now see renewed interest developing around 3,250. The current structure offers a strategic opportunity for…

-

In our previous article, “Nasdaq 100 Pullback: Eyes on 20,700–21,100 as Healthy Correction Unfolds,” we anticipated a retracement in the Nasdaq 100 after a parabolic run. The market followed that view, stalling below key resistance and showing early signs of structural fatigue. 🔄 What’s Happened Since? Despite several bounce attempts, the Nasdaq 100 has struggled…

-

Silver has been one of the most exciting assets in the commodities space recently, with XAGUSD climbing from $35 to test the long-awaited $40 level—a milestone we have been anticipating and sharing with our community for weeks. But the real question now is: what’s next for silver, and why should traders and investors care? 📈…

-

Smart Order Routing (SOR) is an advanced technology used by brokers, trading platforms, and institutional participants to automatically find the best possible price across multiple liquidity providers (LPs), exchanges, or venues when executing a trade. Rather than sending an order to a single destination, SOR dynamically scans and routes the order to the venue offering…

-

In trading, understanding how much you stand to gain or lose is critical. If you’re from a banking or corporate finance background, think of this in terms of notional exposure and currency exchange rather than trading slang like “pips” and “ticks.” Below is a clear guide for how PnL (Profit and Loss) is calculated on…

-

As the financial world digests the impact of Donald Trump’s second presidency, the spotlight returns to the US Dollar Index (DXY). A historical and comparative analysis between his first term (2016–2020) and second term (2024–2025) reveals distinct economic backdrops and differing fiscal/monetary policies, each shaping the dollar’s path in unique ways. First Term (2016–2020): Volatility…