Your basket is currently empty!

As tensions intensify in the Middle East, financial markets are entering the new week with a heavy risk-off tone. One of the assets likely to react first to these developments is gold (XAUUSD). Based on our multi-timeframe analysis and weekend indicators, we anticipate a potential bullish gap at market open today, with the price of gold potentially surging first toward $3400, then to $3440, and possibly $3500 depending on market momentum.

But how do we come to this conclusion? We use a unique correlation model involving Bitcoin (BTCUSD) — particularly during the weekend when traditional markets are closed.

Using BTCUSD as a Weekend Risk Sentiment Indicator

Bitcoin trades 24/7 and provides valuable clues about investor sentiment when traditional markets are offline. Here’s how we interpret BTCUSD’s weekend performance and how it maps onto broader market expectations:

- When BTCUSD rises over the weekend, it signals increased risk appetite. This typically supports US indices, weakens the US Dollar, and pushes risk-on currencies like EURUSD and GBPUSD higher, while safe havens like USDJPY, USDCAD, and gold may pull back.

- When BTCUSD falls, it signals risk aversion. In this case, investors tend to flee toward safe havens, leading to higher gold prices.

This weekend, BTCUSD pointed firmly toward risk-off.

BTCUSD Analysis Breakdown

BTCUSD_1 – Hourly Chart

On Saturday (June 21, 2025), we anticipated that BTCUSD would drop from 103400 to 102420, based on horizontal support levels. That move played out as expected.

BTCUSD_2 – Daily Chart

After breaking 102420, the daily chart confirmed the next logical downside target: 100340, which was completed earlier today (June 22, 2025).

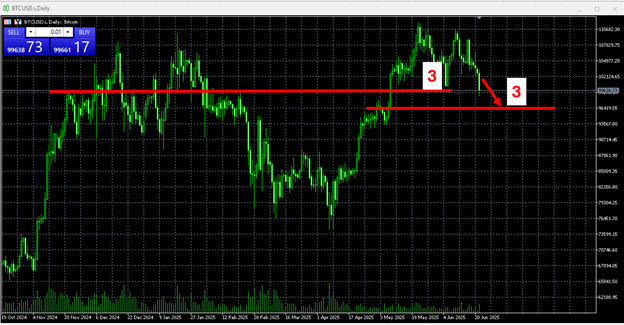

BTCUSD_3 – Weekly/Extended View

Now that 100340 has been broken, I anticipate BTCUSD could decline further toward 96400. This would align with a continuation of the risk-off tone in the broader market.

XAUUSD: The Trade Setup

XAUUSD – Hourly Chart

Given the risk-off environment and safe-haven demand for gold, we expect XAUUSD to move higher. The first resistance sits around $3400, followed by $3440. If momentum strengthens due to further geopolitical developments or broader market fear, gold could rally toward $3500 in the coming days.

Final Thoughts

The alignment of geopolitical risk, BTCUSD’s weakness, and technical levels on XAUUSD present a compelling short-term bullish outlook for gold. While nothing is guaranteed, all signs currently point to safe-haven flows dominating early this week.

📌 Disclaimer

This article is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial professional before making trading decisions.

Leave a Reply