Your basket is currently empty!

Introduction

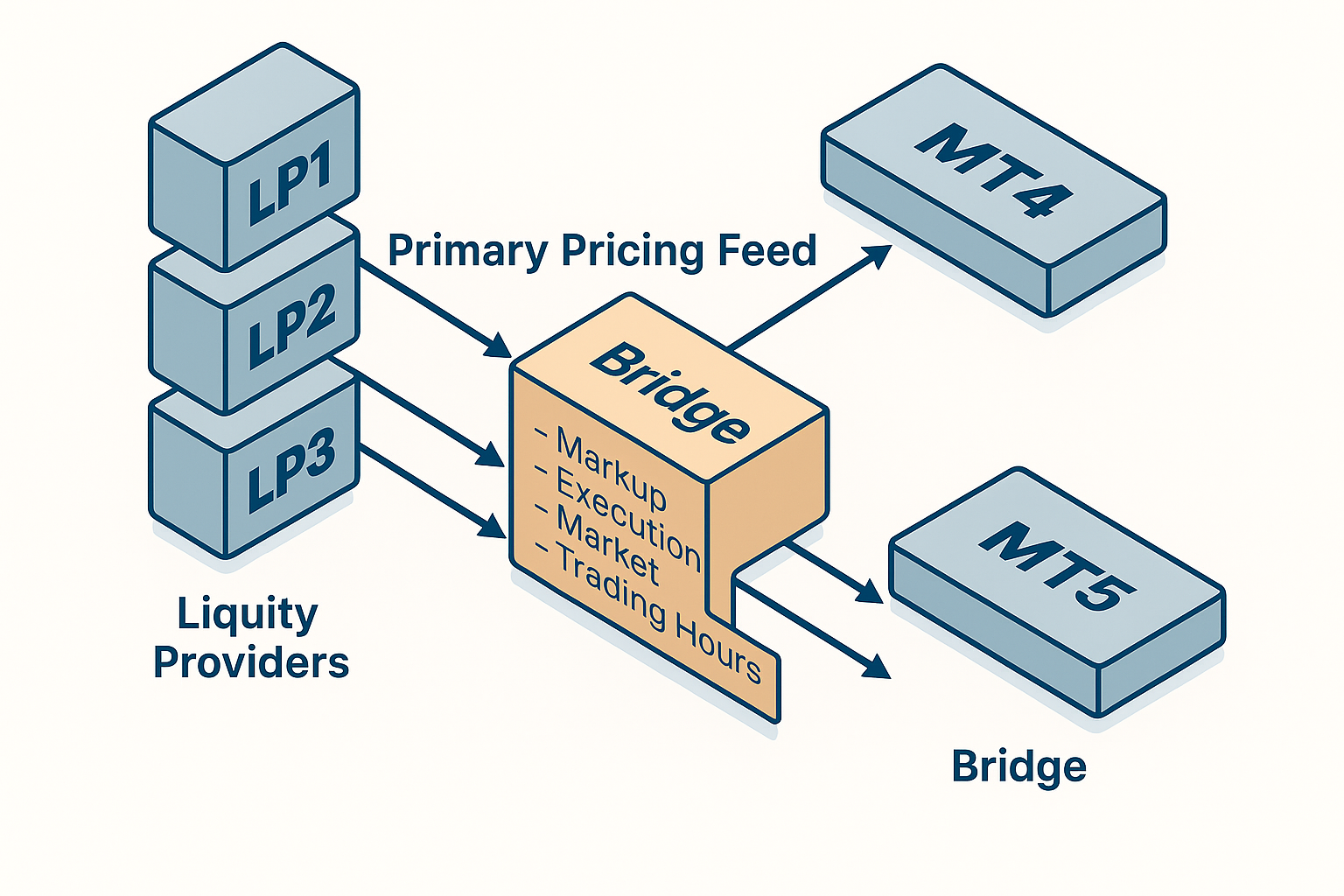

In the fast-moving world of forex trading, brokers must ensure they provide traders with the most competitive prices, fastest execution, and minimal downtime. Achieving this requires a carefully structured infrastructure — one that connects multiple Liquidity Providers (LPs) through a Bridge to popular trading platforms like MT4 and MT5.

The Role of Liquidity Providers

Liquidity Providers (LPs) are financial institutions, banks, or large brokers that offer buy and sell quotes for currency pairs such as EUR/USD. By connecting to multiple LPs, brokers can access deeper market liquidity and better pricing options for their clients.

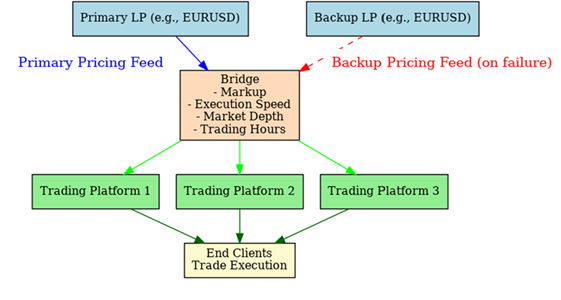

How the Pricing Feeds Work

Each LP sends pricing data to the broker’s bridge. The bridge selects the best available prices and routes them to trading platforms. In case the primary LP feed fails, the system can switch to a backup LP, ensuring uninterrupted trading.

Bridge Configuration

The bridge is more than a simple connection — it’s an intelligent system that applies broker-specific settings before prices and trade requests reach MT4/MT5. This includes:

- Markup: Adjusting spreads to generate broker revenue.

- Execution Speed: Optimizing the speed at which orders are processed.

- Market Depth: Displaying multiple levels of buy/sell orders.

- Trading Hours: Restricting or allowing trading based on schedules.

MT4 and MT5 Integration

Once the bridge processes the data, it routes it to MT4 and MT5 trading platforms, where traders execute their orders. This seamless integration ensures the trading experience remains smooth, transparent, and fast.

Conclusion

By connecting multiple LPs via a bridge to MT4/MT5, brokers provide traders with the best prices, high liquidity, and uninterrupted service. It’s a behind-the-scenes process that makes a huge difference in trading performance and reliability.

Leave a Reply