Your basket is currently empty!

The EURUSD pair closed last Friday (20/06/2025) at 1.15214, and as markets reopens today (22/06/2025) at 10pm UK time, the pair will open with a downside gap around 1.1470. This bearish gap comes amid escalating tensions in the Middle East, raising investor caution and driving flows into the U.S. Dollar as a safe-haven currency.

Why the Gap?

Geopolitical instability tends to increase demand for safety. With recent developments over the weekend in the Middle East, traders have moved out of riskier assets such as the euro and into the perceived security of the dollar. The result: a bearish open on the EURUSD chart.

Technical Outlook: Path Toward 1.1290

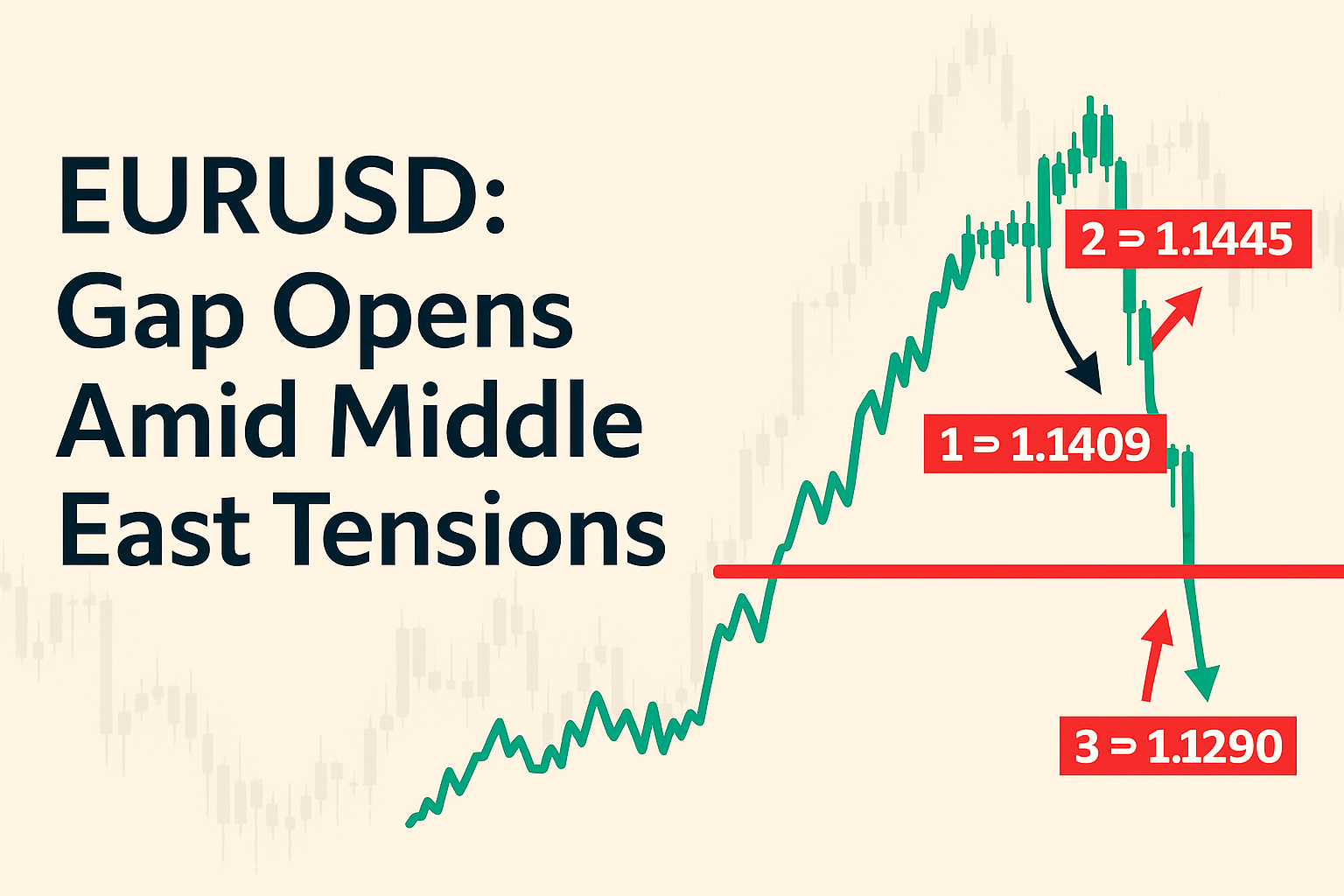

The technical setup shows a clear pattern emerging, suggesting the bearish momentum may not be over yet:

- Zone 1 (Support): 1.1409

This level stands as the first key support. With price opening below 1.1470, a move toward this level appears likely in the near term. - Zone 2 (Correction): 1.1445

Once 1.1409 is tested or broken, we could see a minor corrective bounce back toward the 1.1445 level. This is often a retracement zone before trend continuation. - Zone 3 (Target): 1.1290

If the downtrend persists, 1.1290 becomes the next bearish target. This level aligns with a previous consolidation zone and offers a logical destination for further downside.

Geopolitical Influence on Currencies

The euro’s vulnerability to global geopolitical shocks stems from Europe’s close economic links to oil and natural gas markets and its geographic proximity to the Middle East. As the situation escalates, the risk-off tone in the markets weighs more heavily on EURUSD, driving the pair lower.

This situation reflects a broader sentiment shift: markets are de-risking. That means less demand for high-yield or risk-sensitive currencies, more for safety. Until the Middle East picture stabilizes, the dollar may remain bid and the euro pressured.

Final Thoughts

The gap down on EURUSD is more than just a chart event—it’s a reflection of rising global concern. While a correction toward 1.1445 is possible, the broader structure suggests a move toward 1.1290 is likely in play unless geopolitical conditions unexpectedly improve.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Always conduct your own research before making any trading decisions.

Leave a Reply