Your basket is currently empty!

As the financial world digests the impact of Donald Trump’s second presidency, the spotlight returns to the US Dollar Index (DXY). A historical and comparative analysis between his first term (2016–2020) and second term (2024–2025) reveals distinct economic backdrops and differing fiscal/monetary policies, each shaping the dollar’s path in unique ways.

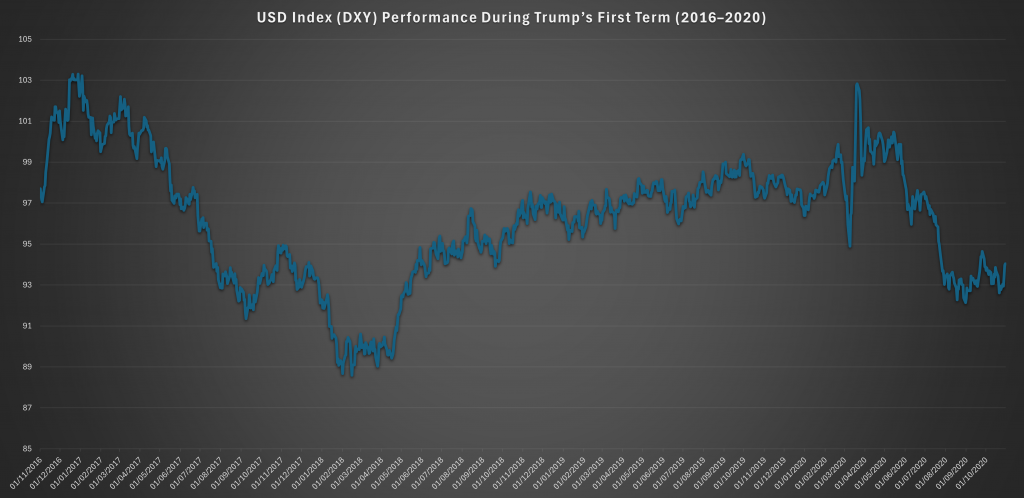

First Term (2016–2020): Volatility in a Globalised Expansion

The DXY opened strong in early 2017, peaking above 103, reflecting post-election optimism on corporate tax cuts, infrastructure spending, and pro-growth policies. However, the index entered a downtrend throughout 2017 as global synchronised growth picked up, reducing demand for the dollar as a safe haven.

Between 2018 and early 2020, the dollar index largely ranged between 95 and 99. Key drivers included:

- Fed rate hikes (2017–2018),

- Trade war uncertainty (particularly with China),

- Global economic divergences.

The onset of COVID-19 in early 2020 saw a brief spike in the DXY as liquidity dried up, followed by a sharp collapse below 90 as the Federal Reserve slashed rates and initiated quantitative easing.

📉 DXY dropped from ~103 (early 2017) to below 91 by late 2020 – signalling a long-term weakening cycle underpinned by lower rates and higher fiscal stimulus.

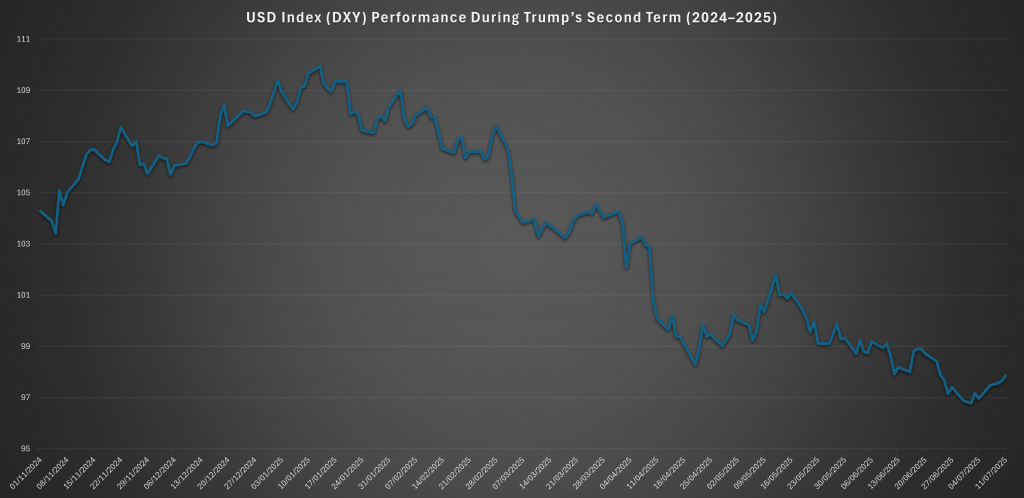

Second Term (2024–2025): Policy Strength Meets Market Repricing

Trump’s second presidency, starting November 2024, opened with relative optimism and geopolitical uncertainty. The DXY surged initially, climbing from 103 to nearly 110 in late 2024, likely due to:

- Hawkish stance on inflation control,

- Trade re-negotiations and tariffs,

- Repatriation rhetoric and reshoring themes.

However, the momentum faded in 2025. Amid weakening economic data, rising fiscal deficits, and expectations of Fed easing, the dollar index entered a persistent downtrend.

📉 DXY fell from 110 to below 97 within less than 8 months in 2025 – a sharper and more compressed drop than in the previous term.

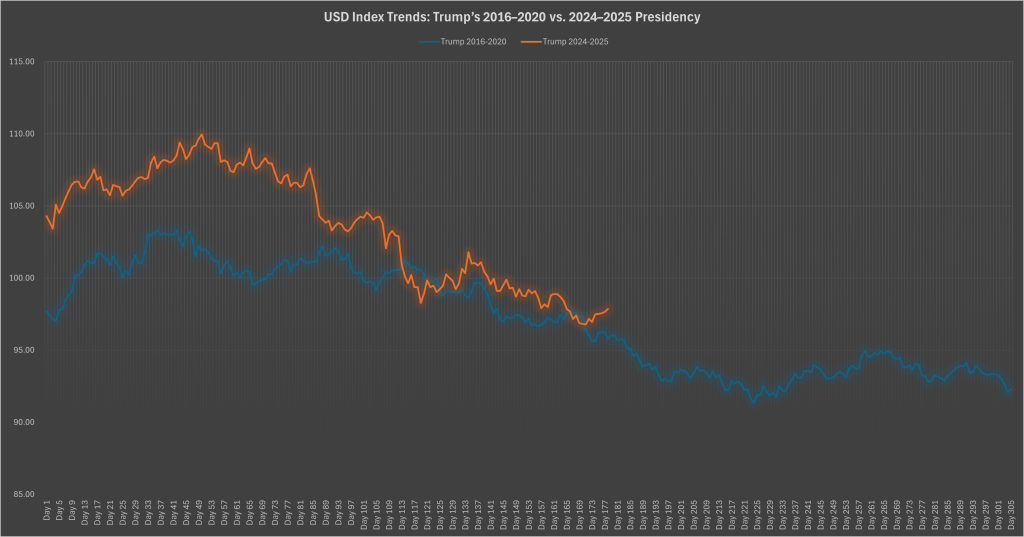

Comparative Analysis: A Clear Divergence

- Trump 1st Term: Dollar remained volatile but ranged broadly, supported intermittently by Fed hikes.

- Trump 2nd Term: Dollar showed an initial surge but suffered an accelerated and sustained fall, possibly as markets priced in deeper structural concerns.

Trading Strategy: Navigating a Weaker Dollar

Based on the second-term trajectory, traders and investors may consider the following USD-bearish strategies:

✅ FX Pairs to Watch:

- EURUSD: More upside as EUR strengthens against a weakening dollar.

- XAUUSD (Gold): Safe-haven flows and weaker USD make gold an attractive long-term long.

✅ Equity Markets:

- Emerging Markets (EM): A weaker dollar supports capital flows into EM equities and debt.

- US Multinationals: A cheaper dollar boosts overseas earnings (e.g., technology, industrials).

✅ Commodities:

- Oil, Copper, and Soft Commodities: Dollar weakness can inflate commodity prices, providing tailwinds to producers.

Conclusion: Second Term, Softer Dollar

Donald Trump’s second term, so far, has introduced a dollar profile defined by sharp repricing rather than gradual unwinding. If the downtrend in the DXY continues, positioning portfolios for a structurally weaker greenback could prove beneficial. Monitoring Fed policy shifts and geopolitical developments will be key in confirming this trend and guiding tactical execution.

Leave a Reply