Your basket is currently empty!

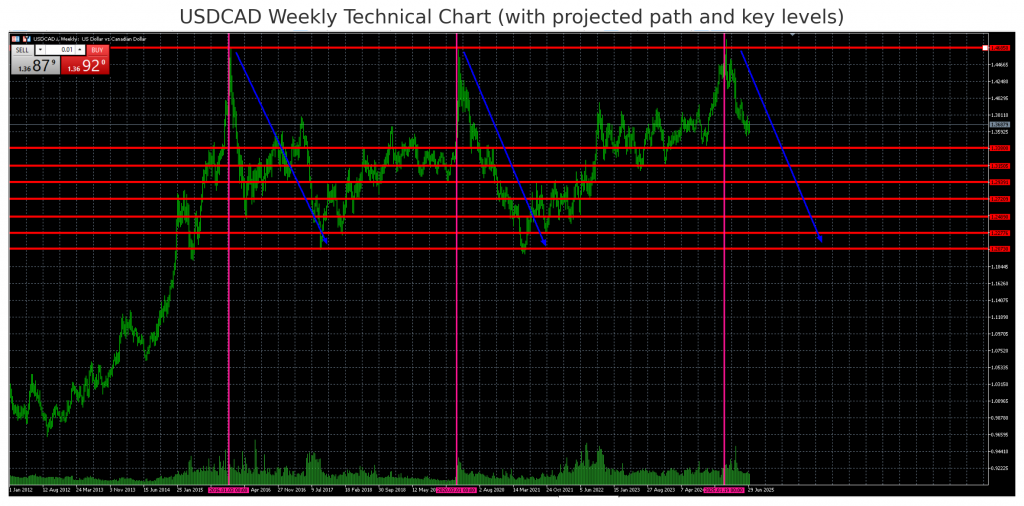

The USDCAD pair appears to be entering a technically significant bearish phase. The pair has failed to hold above the 1.3860 zone, forming a triple top pattern that historically triggered medium-term declines.

🔍 Key Technical Observations:

• Downward Pressure Confirmed: A series of lower highs suggests sustained selling pressure.

• First Major Target: The initial support is seen at 1.3380, a level that has acted as both support and resistance in the past.

• Second Target: If broken, price may slide further toward 1.3150, which served as a major reaction level throughout 2022–2023.

• Next Zones: Further continuation could aim for 1.2939, 1.2702, and possibly even 1.2489 depending on macro sentiment and oil prices.

📆 Contextual Factors to Monitor:

• Crude oil strength tends to benefit CAD (Canadian Dollar), weakening USDCAD.

• Fed vs. BoC rate divergence could act as the primary macro catalyst.

• Broad USD pressure post-inflation data could drive momentum into these support zones.

Leave a Reply