Your basket is currently empty!

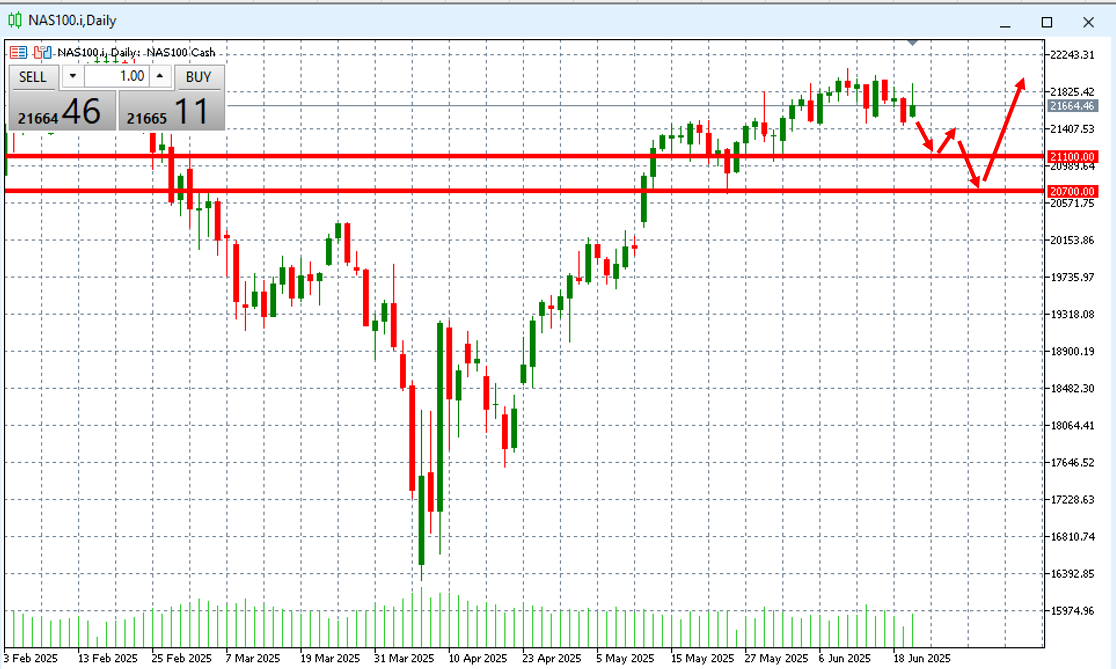

After a relentless rally from the March lows, the NASDAQ 100 (NAS100) appears to be entering a much-needed cooldown phase. With price action showing signs of local exhaustion and overhead resistance near all-time highs, traders may be eyeing a pullback — not as a bearish reversal, but as a buy-the-dip opportunity into a strong trend.

🧭 Current Setup: Pullback Within an Uptrend

Since bottoming out in April near 16,200, the NAS100 has surged over 30% in just a few months. This parabolic move has now paused around the 21,600–22,000 zone, where historical resistance and technical overbought conditions are coming into play.

Rather than a trend change, this appears to be a structural correction — a chance to reset before the next leg higher.

📉 Current Price: ~21,665

📊 Target Buy Zone: 20,700–21,100

🔼 Macro Trend: Bullish until proven otherwise

📐 Technical Analysis: Structure & Retracement

- Support #1: 21,100 — Previous breakout level

- Support #2: 20,700 — Fib retracement zone (likely ~38.2% depending on swing used)

This zone offers confluence support where bulls are likely to reassert themselves.

Volume has thinned out on the recent rise, suggesting the need for a deeper retest — and price rarely moves in a straight line.

🔎 Market Context: Tech Resilience vs. Macro Drag

Despite looming interest rate uncertainty and global election cycles, tech stocks continue to dominate flows. AI, chipmakers, and Big Tech earnings remain strong tailwinds.

However, traders should remain cautious of:

- Upcoming earnings reports

- Any Fed pivot in tone

- Liquidity shifts from election risk

These could spark short-term volatility, pushing price into the 20,700–21,100 region — but that’s exactly where the opportunity lies.

🧠 FXEQ Playbook

At FXEQ, we view this as a trend continuation opportunity with tactical patience.

📌 Entry zone: 20,700–21,100

🎯 Target 1: Retest of 21,800

🎯 Target 2: New highs above 22,400

🛑 Stop-loss: Below 20,000 (invalidates bullish structure)

⚠️ Disclaimer

This analysis is for educational and informational purposes only. It does not constitute investment advice or a recommendation to trade. All trading carries risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial advisor before making investment decisions.

Leave a Reply