Your basket is currently empty!

Arbitrage in financial markets is often elusive — a textbook concept that rarely survives the friction of the real world. But today (08/08/2025), we capitalised on a genuine price divergence between spot gold (XAUUSD) and December 2025 gold futures (GOLDft). And unlike typical inefficiencies, this one was not a mispricing, but rather the result of a real structural change.

📸 The Trade Setup

The trade strategy is as follows:

| Asset | Action | Volume | Entry Price |

|---|---|---|---|

| XAUUSD (Spot) | Buy | 200 Ounces | $3,402.30 |

| GOLDft (Futures) | Sell | 200 Ounces | $3,494.38 |

This created a spread of $92.08 per ounce — significant by any historical or theoretical measure.

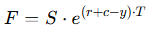

🧮 The Theory: Spot–Futures Parity

Traditionally, the relationship between spot and futures is governed by the cost-of-carry model:

With:

- Spot price: $3,396.50

- Interest rate: 4.9%

- Storage cost: 0.5%

- Time to expiry: ~0.4 years

🔍 This gives a fair value futures price of around $3,470.47.

Yet the actual futures price was $3,494.38+, creating a $24+ premium above fair value — before even accounting for short-term spikes beyond $3,530.

🚨 Not a Mispricing — A Tariff-Driven Premium

According to Reuters, this divergence is no accident. The U.S. has imposed new tariffs on 1kg and 100oz gold bars, particularly affecting imports from Switzerland — a key refining hub.

This policy change reclassified gold bars under a new U.S. tariff code, instantly increasing the cost of delivery to the U.S. This supply chain disruption inflated the price of U.S.-traded gold futures (COMEX) while spot gold remained unaffected in international markets.

So this wasn’t a classical arbitrage opening due to pricing error — it was a structural repricing caused by government policy.

💸 Real Profit, Real Trade

Despite the nature of the price gap, we executed the following:

- Bought 2 lots of spot gold at $3,402.30

- Sold 2 lots of Dec 2025 gold futures at $3,494.38

📈 Live Unrealized PnL (as of August 8, 2025):

| Position | PnL |

|---|---|

| Spot | –$574.00 |

| Futures | +$2,032.00 |

| Net | +$1,458.00 ✅ |

This confirms the viability of the trade for those with the right access, infrastructure, and understanding of macro policy effects.

🧠 The Lesson: Structural Arbitrage > Theoretical Arbitrage

This isn’t just an academic example — it’s a real-world opportunity born of regulation, not inefficiency. Traders and institutions that understand how policy, logistics, and trade flows interact with futures markets can unlock substantial alpha.

✅ Final Thoughts

- This isn’t your standard arbitrage. It’s more accurate to call it a regulatory spread opportunity.

- The risk was mitigated by perfect hedging: long spot vs short futures.

- The profit was real and quickly realised — and more could follow if the dislocation persists.

🟨 Gold traders, stay alert. The market is efficient… until policy makes it inefficient.

If you want to stay ahead of trades like this, follow us at [FXEQ Trading Limited] or join our live strategy feed.

Leave a Reply